Contents:

Certificate and degree programs may help candidates bypass some junior-level experience requirements. Even so, building your knowledge of essential bookkeeper duties through practice always helps. Hands-on learning opportunities like internships and practicums allow aspiring bookkeepers to gain education and experience at the same time.

He began his professional career in editorial services in 2001 and… You can take this exam from anywhere, as long as you have a reliable internet connection. One organization to look into is The American Institute of Professional Bookkeepers. They provide bookkeeping certifications and training, which can officially make you a Certified Bookkeeper. If you want to become a bookkeeper and also start a bookkeeping business, there are a few things to consider.

What are the certifications among bookkeeping requirements?

Bookkeepers help manage your day-to-day finances to ensure your finances are in order. They record income and outflow of money, property, and other financial assets. The most important bookkeeper duty is to record and review all financial data accurately. To excel as a bookkeeper, you must pay close attention to details and be very accurate when recording numerical data. The bookkeeping job will also require you to be ethical and to maintain the confidentiality of a client’s financial records.

Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. As a financial auditor, you may work as an external or internal auditor. If you are an external auditor, you will most likely have a job at a public accounting firm, and you will need to have a CPA license, plus a college degree, and often a master’s degree.

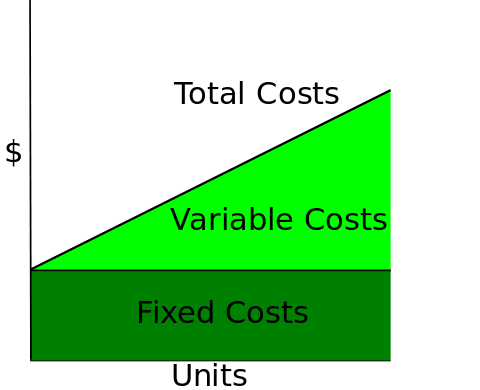

With double-entry bookkeeping, you create two accounting entries for each of your business transactions. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided. The differences in median wages, entry-level education, and experience and training are shown in Table 2. On the surface, this negative growth rate indicates that the need for back-office support will decrease substantially in the near term. A forensic accountant’s job is to investigate, audit, and prove the accuracy of financial documents and dealings. These accounting detectives’ work often centers around legal issues.

How Much Does a Bookkeeper Cost?

Having a bookkeeper on hand will save you a lot of time if your payroll is done weekly. Drive your business in your own way, but without experienced accounting and bookkeeping services your revenue and time both will sustain. Subcontracting your enterprise, accounting and taxation will bestow you better time on highly productive and high-value undertakings. It might seem counterintuitive to hire someone else to handle your bookkeeping, but it will actually save you money in the long run.

How To Start A Bookkeeping Business (2023 Guide) – Forbes

How To Start A Bookkeeping Business (2023 Guide).

Posted: Wed, 04 Jan 2023 08:00:00 GMT [source]

There are opportunities for forensic accountants in many industries, like nonprofit work, government and law-enforcement agencies, law firms, and large corporations. An enrolled agent is a tax professional authorized by the United States government. Their job is to advocate and assist taxpayers when they have issues with the Internal Revenue Service. To become one, you have to either have worked at the IRS or pass an EA examination.

Dedicated to helping small business owners grow their companies through effective financial management. Hill Bookkeeping & Consulting is LGBTQIA+ friendly and a transgender safe space. Some accountants also do bookkeeping work and they often do a terrible job of it. But you still probably don’t want them to do your bookkeeping unless you have a wealth of disposable income. That CPA certification costs money and comes with a HEAVY premium. Bookkeepers offer support to a number of organizations, including small businesses, nonprofits, and corporations.

What is a Bookkeeper?

If your taxes have become too complex to manage on your own, with multiple income streams, foreign investments, several deductions or other considerations, it’s time to hire an accountant. An accountant can save you hours and help you stay on top of important matters like payroll, tax deductions and tax filings. To earn the certified public bookkeeper license, bookkeepers must have 2,000 hours of work experience, pass an exam, and sign a code of conduct. They must take 24 hours of continuing education each year to maintain their license. The NACPB offers credentials to bookkeepers who pass tests for small business accounting, small business financial management, bookkeeping and payroll. It also offers a payroll certification, which requires additional education.

- Let’s drill down into what each does, how they work together, and who you need to work with for what.

- If you opt for bookkeeping software—like Quickbooks—keep in mind the time commitment required to learn how to properly use the program.

- Our innovative experts with Tech advancements allow aid in delivering high-value services.

- This Bookkeeper job description template is optimized for posting on online job boards or careers pages.

BLS definitions of “Bookkeeping, Accounting, and Auditing Clerks” include bookkeepers, accounts receivable clerks, and auditing clerks, among others. “Accountants and Auditors” include public accountants, cost accountants, financial accountants, fund accountants, internal auditors, and tax accountants. On a day-to-day basis, Bookkeepers complete data entry, collect transactions, track debits and maintain and monitor financial records. They also pay invoices, complete payroll, file tax returns and even maintain office supplies. For example, some small business owners do their own bookkeeping on software their accountant recommends or uses, providing it to the accountant on a weekly, monthly or quarterly basis for action.

In 1494, Pacioli published “Summa de Arithmetrica, Geometrica, Proportioni et Proportionalita .” Effectively, he introduced double-entry bookkeeping and accounting to the world. Today, many use Pacioli’s core bookkeeping and accounting principles to streamline business finances. Another big responsibility of bookkeepers is that they prepare invoices and send them to your clients so you can receive payment on time.

How To Make an Extra $1000 a Month – The Everygirl

How To Make an Extra $1000 a Month.

Posted: Tue, 18 Apr 2023 05:01:24 GMT [source]

You’ll be dealing with a lot of financial data and numbers in this career path. If you’re not a numbers person, it may be worth practicing some basic accounting and math skills to prepare for this type of career. If you’re bad with numbers, hire a bookkeeper to keep your financial records. Ageras’ large-scale, comprehensive network lets us find help for businesses of every size, every industry, and every corner of the country.

Advantages of a bookkeeper

Donna has carved out a name for herself in the accounting cycle and small business markets, writing hundreds of business articles offering advice, insightful analysis, and groundbreaking coverage. Her areas of focus at business.com include business loans, accounting, and retirement benefits. Check out our reviews of the best accounting software for small businesses so you can create invoices, record payments, collect receivables and run reports that help you manage your financial health.

Bill Von Fumetti Reviews: Training the Next Generation of … – The Ritz Herald

Bill Von Fumetti Reviews: Training the Next Generation of ….

Posted: Tue, 14 Feb 2023 08:00:00 GMT [source]

However, if you need insight and advice on how to better operate your business at scale…you will need help from an accountant. Accounting and bookkeeping similarities and differences, and how to determine which to hire. Have your questions answered and learn more about QuickBooks Live Bookkeeping. Forensic accountants investigate financial crimes involving fraud, embezzlement and other issues.

In some cases, your cleanup may take longer depending on timeliness of documentation and the complexity of your books. Get paired with a team of QuickBooks-certified bookkeepers with small business experience. With an average of over 10 years experience, our bookkeepers have your bookkeeping covered. Contact local CPAs or tax professionals to see if they can offer their services without in-person contact. Many firms can operate remotely or virtually, and others that typically operate face-to-face may be changing their procedures to keep up with social distancing guidelines. Our group represents considerable authority in bookkeeping, warning, finance, and expense consistency.

- She has been in the accounting, audit, and tax profession for more than 13 years, working with individuals and a variety of companies in the health care, banking, and accounting industries.

- After meeting the qualifications to be a bookkeeper, you can focus on the job hunt.

- Each bookkeeping professional has their own expertise, just like each business has unique financial circumstances and bookkeeping needs.

- Then provide them with all the documentation they require, including W-2s, 1099s and more.

- They record and organize financial statements, ensure compliance with important tax rules, and facilitate all ingoing and outgoing payments on specific business accounts.

A bookkeeper must be able to shift focus easily and catch tiny, hidden mistakes in a budget or invoice. They often bookkeepers work a few jobs for various clients if they work as a consultant. Some bookkeepers use their knowledge and experience to pursue accountant careers. Certified public accountants are one of the most popular such paths.

Comentarios recientes